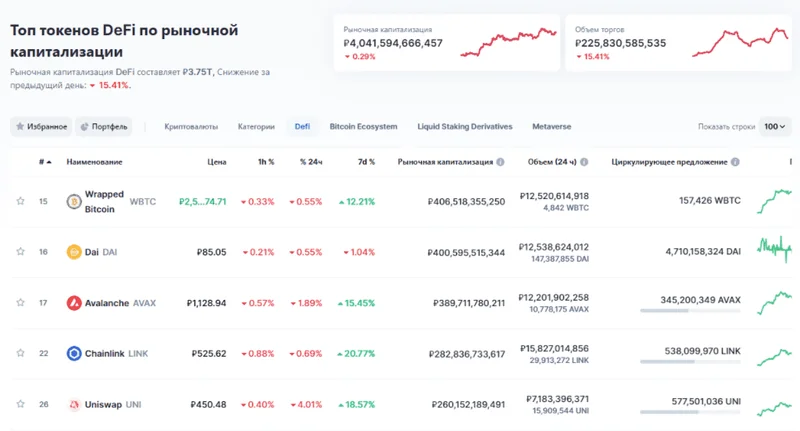

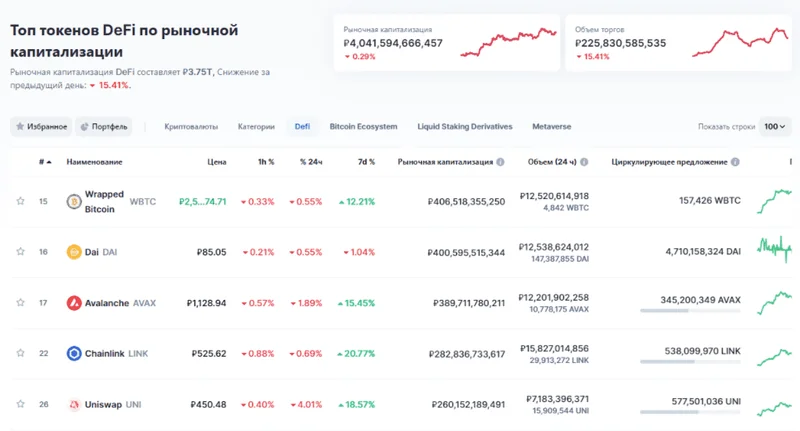

The DeFi sector is singing the blues this November. As of November 20th, a mere two out of 23 leading DeFi tokens are showing positive year-to-date (YTD) returns. Quantify that pain: the group is down an average of 37% quarter-to-date (QTD). Bitcoin, after hitting a high of $125,500 in October, has since cooled off. Spot Bitcoin ETFs recorded nearly $4 billion in net outflows this month, the worst since February. Is this a temporary setback, or are deeper structural issues at play?

Crypto's Two Faces: Boom and Bust, Simultaneously

The Divergence of Crypto

We're seeing a divergence in the crypto space. El Salvador, ever the contrarian, bought 1,090 BTC at around $90,000 each this month. (One wonders if they timed the market correctly.) Meanwhile, Kalshi, a prediction market platform, raised a staggering $1 billion at an $11 billion valuation. Grayscale launched a Chainlink ETF, and Canary Capital's XRP ETF saw $26 million in volume within the first half-hour of trading. So, it's not all doom and gloom, but the picture is undeniably mixed.

Consider TRON: its DEX volume surged 174% to $3.04 billion in October, with a massive 87.72 million active addresses. Zcash (ZEC) traded at $341.69 in October, a 560% jump from September lows. GoPlus, a security firm, has generated $4.7 million in revenue across its product lines, with the GoPlus App being the primary driver at $2.5 million (about 53%). Since its January launch, the $GPS token has registered over $5 billion in total spot volume and $10 billion in derivatives volume this year. The data suggests that while some areas are struggling, others are thriving.

Fractured Sentiment: Tech vs. Governance in DeFi

The Community Pulse

Community sentiment, as always, is a mixed bag. On Reddit, Bitcoin discussions are split between "HODL" optimism and warnings against over-leverage. Solana's community praises its speed and low fees, but there are concerns about meme coin reliance. The XRP community has shifted towards utility-focused discussions, while Chainlink's "LINK Marines" are focusing on infrastructure. Ondo Finance's community is split, with believers praising RWA leadership and frustrated holders pointing to the ATH decline. Hyperliquid's X (formerly Twitter) shows 51% bullish sentiment, but critics raise decentralization concerns.

Here's where the numbers get interesting, and this is the part of the report that I find genuinely puzzling. NEAR Protocol completed its first-ever mainnet halving on October 31st, reducing annual token inflation from 5% to 2.5%. Sounds good, right? Except, the halving proceeded *despite* the original governance vote failing, with key validators criticizing it as a "dangerous precedent." Arbitrum, meanwhile, has around $2.69 billion in total value locked (TVL), yet frustration persists over weak price action. Zcash's community is split between privacy advocates and skeptics warning of a speculative bubble. It's not just about the tech; it's about the governance and the narratives.

The October 10th crash continues to reverberate, and investors seem to be opting for safer names or those with fundamental catalysts. Certain DeFi subsectors have become more expensive, while some have cheapened relative to September 30th. Lending and yield names have broadly steepened on a multiples basis, as price has declined considerably less than fees. BlackRock registered the iShares Staked Ethereum Trust in Delaware, signaling plans for a yield-generating ether ETF. Mastercard expanded its Crypto Credential system to self-custody wallets, using Polygon's blockchain for KYC-verified identities. These are moves of institutional players, positioning themselves for the long game.

Bitcoin dominance dropped from 64.5% earlier in the year to 58% in October. Altcoins have mostly performed in line with, or even better than, BTC, with market benchmarks CoinDesk 5 Index (CD5) and CoinDesk 20 Index (CD20) showing relative outperformance. Ondo Finance leads early-stage opportunities with partnerships including BlackRock and Goldman Sachs. Solana and XRP are established large-caps benefiting from ETF speculation and institutional treasury allocations. Early-stage tokens like Ondo and Immutable target underutilized sectors with strong institutional catalysts and higher growth potential. The crypto market faced $638 million in liquidations mid-October, and these pullbacks might present optimal entry points before the next leg up.

Still Too Risky to Call a Bottom

The data paints a nuanced picture. Some DeFi sectors are struggling, while others are showing resilience. Institutional interest remains, but community sentiment is fractured. The key question isn't whether DeFi is "dead," but whether the current valuations accurately reflect the underlying risks and opportunities. My analysis suggests that while there are pockets of value, the sector as a whole still carries significant risk. Until we see more consistent performance and clearer regulatory frameworks, I'm staying cautious.